Guide to Choosing Delegated Investment Management Services for Corporate Pensions

Delegating fiduciary responsibility for key investment decisions to an external provider has emerged as a significant trend in the world of corporate pensions. This approach is known by many names – e.g., delegated investment services, outsourced chief investment officer (OCIO), fiduciary management services, discretionary asset management. There are dozens of providers and, seemingly, as many different investment philosophies, execution strategies and approaches to client service.

Delegated investment services provided to a pension plan sponsor are distinguished from the traditional investment consultant service model by the additional level of responsibility and fiduciary accountability taken on by the investment advisor. In this new model, investment committees give the provider full discretion over certain investment decisions. The delegated investment service provider, rather than the sponsor or its investment committee, sets the asset allocation and chooses managers.

This works due to a previously obscure section of the Employee Retirement Income Security Act of 1974 (ERISA). This section of code – §3(38) – allows a plan sponsor to delegate control and authority for certain investment management functions, thereby transferring those fiduciary obligations. However, a plan sponsor who chooses the path of delegated investment services cannot rid itself of the fiduciary responsibility related to selecting the delegated investment service provider and monitoring the continuing appropriateness of the chosen provider.

Why do pension plan sponsors hire an OCIO?

There are several key advantages to a plan sponsor of delegating responsibility to an OCIO:

- These external providers generally have extensive expertise and experience with liability-driven investing (LDI). Liability-driven approaches can be a challenge for the typical investment committee to implement.

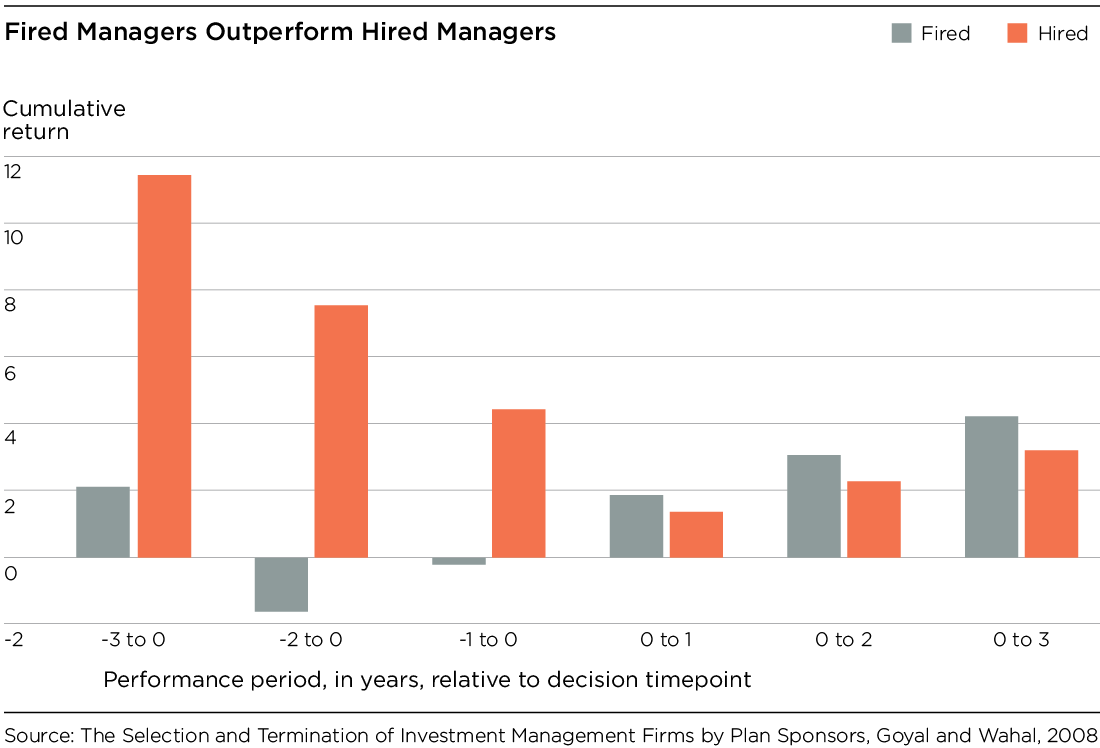

- Selecting managers and the handling of any tactical asset allocation are put in the hands of experts with significant experience and resources dedicated to making these kinds of decisions. See the chart on the following page that shows the results of a study illustrating how challenging it is to choose managers effectively.

- Investment committees encounter issues such as lack of expertise, “groupthink,” or the hurdle of simply getting the whole group together on a regular basis. Delegating decisions to an outside expert can mitigate or eliminate these common problems.

- Lower investment fees are achieved via economies of scale resulting from the OCIO’s overall asset base.

The right kind of delegation will free up time for the investment committee. The committee will spend less time making decisions such as manager selection, where studies like the one summarized in the chart show that committee decisions can detract from performance. With the right OCIO arrangement and provider, the committee can spend more time focusing on oversight and strategic asset allocation.

Additional considerations

There are some issues that should be weighed carefully before delegating investment authority to another party:

- The extent to which fiduciary responsibility for investment decisions can actually be transferred is not clear and has yet to be tested in litigation.

- There is potential for conflicts of interest to arise in some OCIO arrangements.

- OCIO providers may be subject to some of the same decision-making biases and problems that are issues for the typical investment committee.

- Plan sponsors with expert resources on staff and an investment committee and decision-making process that are working well may feel better about retaining responsibility for all investment decisions.

Type of firms offering delegated investment services

OCIO providers generally come in three flavors:

- Actuarial consulting firms These firms have long had investment consulting practices that leverage their knowledge of pension liabilities and have recently invested in infrastructure, such as trading software and custody relationships, to be able to take on delegation.

- Investment consulting firms These firms, too, have set up the infrastructure that allows them to take on delegation. Some of these firms have been in the delegated investments business the longest and many of them have beefed up their actuarial and liability-driven investment (LDI) capabilities in recent years.

- Asset managers These firms already have the resources and infrastructure for delegation readily available. Many of these firms have also strengthened their actuarial capabilities in order to effectively design and implement LDI solutions.

Each firm has strengths and weaknesses, some of which spring from their origins, but these do not lend themselves to simple metrics. Because investment perspectives and approaches to implementation are different at every OCIO, choosing a firm is not so much about identifying strengths and weaknesses as it is about finding a firm with an investment philosophy that matches the plan sponsor’s.

Considerations when evaluating OCIO providers

The following provides an overview on factors to consider when evaluating the different OCIO providers.

Investment performance

Past performance is not a key factor on which to base your choice of OCIO provider. Investment philosophy and cost are more important.

Although past performance should be examined, historical investment returns should not be the primary focus for evaluating an OCIO. Most delegated solutions will be customized to the needs and perspectives of that particular sponsor and not easily evaluated in a vacuum. So, comparing investment performance track records for OCIO providers will always be a challenge and is probably not a particularly useful factor in making a decision about which OCIO firm will make the most sense for the organization.

Investment perspective

On the other hand, the OCIO’s perspective on such issues as active versus passive management, use of derivatives and alternative investments, and approaches to strategic and tactical asset allocation are all important. Perspectives on these issues should ring true with the sponsor. There are not necessarily right and wrong answers that clearly lead to better results, but a sponsor won’t have success with a firm that doesn’t share its views.

Types of investment management

There are several variations on investment fund management offered by OCIO providers:

- Proprietary funds, managed internally This is most commonly found at asset management firms that naturally use their own funds to implement solutions. Use of proprietary funds should not necessarily be viewed as a problematic conflict, especially for index funds. If fund management fees are reasonable, proprietary funds at a large asset manager can be a sensible way to implement a delegated arrangement.

- Proprietary funds, managed externally In this arrangement, the OCIO firm creates a fund and hires one or more external managers to make the investment decisions for the portion of the fund for which they are responsible. The OCIO firm negotiates a fee with the fund manager and passes that cost on directly to its clients.

- Proprietary fund of funds Under this approach, the OCIO firm purchases shares in funds managed by other managers and combines them together into a single fund vehicle for their client plan sponsors. In some of these arrangements, the OCIO has negotiated favorable fee arrangements based on the entirety of their business with the manager. In some arrangements, the OCIO can make tactical decisions about moving money between managers based on market conditions.

- External funds The OCIO firm simply purchases shares in funds or sets up a separately managed account on behalf of the pension fund. Fees for the external manager may be based on the full level of business from all the OCIO’s clients.

“Open architecture” is prevalent. There are typically few restrictions on keeping favored managers.

Many OCIO firms offer a combination of these types of investment management vehicles. Most arrangements these days are “open architecture,” meaning that a plan sponsor can use most any investment fund from any investment manager as part of the delegated solution. Almost any OCIO firm allows any investment fund to be included in a client sponsor’s portfolio. This can occasionally cause reporting challenges for the OCIO, especially if daily valuation of a portfolio is desired, e.g., for glidepath management.

Paying for OCIO services

Most firms in the business of providing OCIO services are highly cognizant of the potential for conflicts of interest to arise in the way they are paid for their services. It is not typical for OCIOs to have revenue sharing arrangements with fund managers. Transparency should be expected in that OCIOs tell their clients how they make their money and how much the total relationship, including fund management expenses, costs.

For OCIOs who have proprietary funds that are managed internally, the potential exists to profit more from an allocation to a higher-priced fund. For example, an actively-managed fund may have a higher profit margin than an index fund. However, this is not a reason to automatically eschew OCIOs with internally managed funds. One simply must be aware of the issue and ask the right questions when choosing or monitoring a provider.

Level of delegation

There are various aspects of the investment process that can be outsourced:

- Strategic asset allocation While this function can be outsourced, the vast majority of arrangements involve a consultative and cooperative approach to determining the right strategic asset allocation.

Most OCIOs will look to add value with their approach to tactical asset allocation.

- Tactical asset allocation Tactical asset allocation is usually delegated, but some arrangements may call for consultation with the plan sponsor before making changes.

- Manager selection This is the essential function of delegation. The investment committee is freed from the process of searching, interviewing, hiring, monitoring and firing investment managers.

- Contracting with managers Outsourcing this legal function is a natural extension of outsourcing the selection of managers.

- Certain asset classes only An outsourced solution could include, for example, only the liability-matching portfolio or only hedge funds or private equity.

- Custody, brokerage and trustee services Most OCIOs allow their plan sponsor clients to maintain their own custody and trustee relationships. Some offer these services with preferred vendors, and package pricing may be available when these services are bundled with other aspects of delegation.

Derisking glidepath management

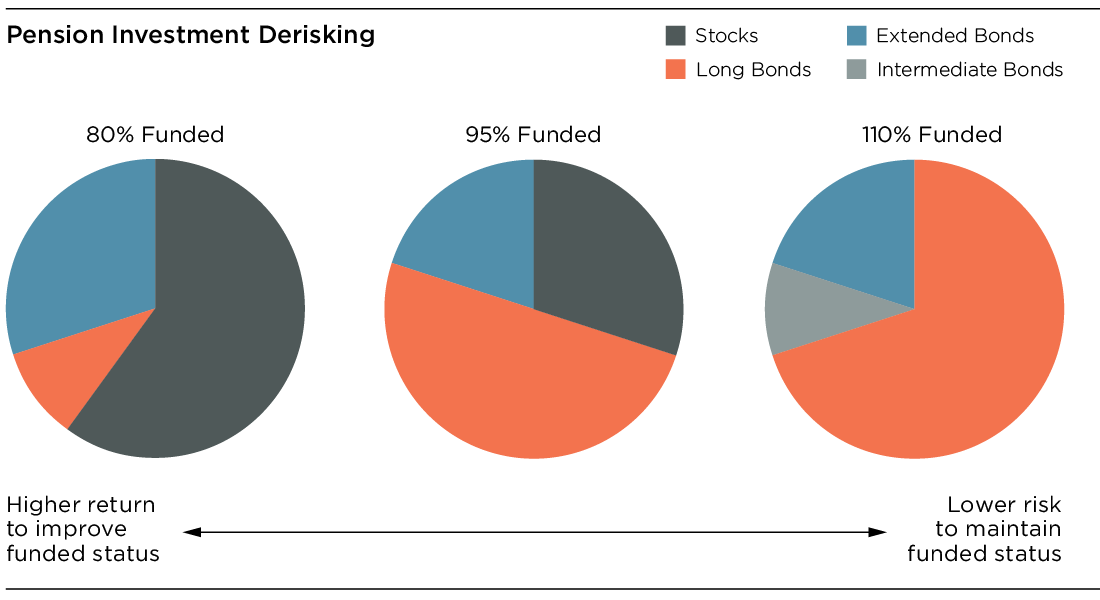

A derisking glidepath gradually replaces, as funded status improves, equities with liability-matching fixed income investments.

Many corporate pension plan sponsors have adopted some kind of glidepath approach to gradually implement a lower risk portfolio as funded status increases, and sometimes based on interest rates as well. There are as many different approaches to glidepath implementation as there are OCIO configurations. Most adapt their approach wholly or at least partially to a client sponsor’s preferences.

Similar to tactical allocation changes under an OCIO arrangement, asset allocation adjustments based on a glidepath approach to derisking are often delegated, but some sponsors want to confirm these moves by phone or e-mail, while others delegate this completely and are only informed after the fact. Some sponsors still gather their entire investment committee together to confirm these changes, but this may defeat the basic purpose of the glidepath approach.

For some plan sponsors who have adopted a glidepath, it is important to be able to monitor funded status on a daily basis and make asset allocation changes within a matter of days after a funded status trigger is reached. Not all OCIOs have developed the capability to monitor funded status on a daily basis, so this may be an important distinction between OCIOs. For sponsors with portfolios containing illiquid assets that are hard to value daily, or for those sponsors that just aren’t comfortable with such quick timing, this may not be an issue.

Glidepath strategies are like snowflakes – no two are exactly alike.

Some OCIO firms have developed more complex approaches to glidepath management that include not only funded status, but also interest rates and sometimes credit spreads as criteria for changing allocations. As with other aspects of choosing an OCIO, it is important to understand and be comfortable with the approach.

Manager databases

Some OCIOs keep extensive databases of investment managers. They may interview hundreds of managers every year and use an explicit grading system to identify their preferred managers. Others may rely exclusively on third-party ratings, and many use some combination of both.

Some OCIOs keep a smaller list of managers with buy, sell and watch ratings. These ratings will drive decisions about which managers to use at any point in time.

Because manager selection is a key aspect of the delegated investment decisions, the OCIO’s manager database and grading system may be an important factor to consider. Considerations might include the factors used to determine grades for hiring and firing decisions, average tenure of managers, and alignment with the plan sponsor’s current set of managers.

Fees

The fiduciary task of choosing a delegated investment provider must necessarily be concerned with the level of fees that will be paid. The typical arrangements include:

- Cost plus A fixed basis point charge is added to the fund management expenses for the investments that are part of a plan sponsor’s delegated solution.

- Bundled The sponsor pays a fixed basis point based charge which covers both fund management and the services of the OCIO. The bundle may also include custody, trustee, and actuarial or other services. This is a convenient and sometimes cost-effective approach, especially for smaller plans. It does present potential for increasing the OCIO’s profit margin (e.g., by moving from actively managed funds to lower cost indexing), and plan sponsors should discuss this issue with providers.

As described above, related services such as custody, trustee, actuarial, or recordkeeping services are available in a bundled solution at a few OCIO providers. Defined benefit and defined contribution services can be combined, too. For smaller plans, this approach may provide not only convenience, but also the potential to enhance efficiency and the effectiveness of implementation.

Some investment consultants charge more for taking on a delegated relationship than for a consulting assignment where they are not §3(38) fiduciaries. However, some do not, in part because the amount of work may actually be less in a delegated relationship, where manager RFPs do not need to be organized, and trades and contracts can be implemented without involvement from the plan sponsor.

OCIO fees range from 0 to 50 bps on top of the fund management expenses.

Relationship pricing may be available from institutions where a plan sponsor has a banking relationship, or from an investment advisor where the plan sponsor has a relationship (delegated or not) with the same firm for the defined contribution plan(s).

The charges for OCIO services naturally depend on the amount of assets for which delegated services are requested. Generally, fees will range from zero (fund management is the only cost) to 10 bps for plans with more than $1B up to about 50 bps for plans with $20M to $50M. When combined with fund management fees, the total cost of solutions will generally be 10 bps or less for very large plans using low cost investments, up to 100 bps or more for smaller plans using more active management or complex liability matching schemes.

How to choose?

With the wide variety of offerings and different types of firms providing delegated investment services, how does one ultimately make a decision about which firm to hire?

Delegating the authority to manage the investments in a pension portfolio, on behalf of the plan participants, is one of the most significant fiduciary actions the investment committee will take. So, first and foremost, it is essential that due care, thorough vetting and a carefully documented process are followed when choosing a provider.

Before embarking on a project to choose an OCIO, it is essential that the ultimate goal for the pension plan is clear. To be sure, OCIOs will help map the path to get there, but the goal and general strategy should already be agreed upon within the organization. If and when a plan will terminate, for example, will be a key factor that determines some of the expertise and services that are needed in the delegated arrangement. Assuming that a liability-driven strategy will be used, the investment committee should be familiar with the underlying principles and terminology for this approach to make discussions with potential delegated providers productive.

There are no obvious right and wrong answers and no OCIO provider is the best fit for every pension plan. In the end, the key factors are likely to be:

- Ability to communicate with the investment committee effectively

- An investment philosophy and perspective that resonates with the committee

- Solutions that are not overly complex and that match the level of sophistication of the sponsor

- An approach to glidepaths that works for the pension plan

- Fees that are reasonable in the context of the market

- An arrangement that includes all the services that make sense for the plan and the organization

Conclusion

The delegation of investment decision-making has the potential to significantly increase how effectively your investment strategy is implemented. Regardless of whether the pension plan will be around for a few years or a few decades or more, outsourcing investment decisions is worth considering. If outsourcing might make sense, it’s important to first understand the objectives and ultimate goals and only then begin a careful and thoughtful process to vet a set of potential providers. Remember that a plan sponsor cannot completely eliminate its fiduciary duty and that choosing an OCIO firm and then monitoring the firm are both significant aspects of that responsibility.