A Concise Budget Primer

Vantage Point: Mini Briefs from The Terry Group and the Global Aging Institute

March 30, 2023

Between the new CBO budget baseline released in February, the President’s 2024 budget proposal released in March, and the looming debt ceiling crisis, the federal budget has been much in the news lately. To help our readers navigate the sometimes confusing issues, concepts, and terminology in the budget debate, this issue of Vantage Point offers a concise budget primer.

The federal budget has been much in the news lately. In February, the Congressional Budget Office (CBO) released its new baseline budget projections, which show the national debt climbing to record levels and the Social Security and Medicare trust funds sinking inexorably toward insolvency. In March, the President submitted his 2024 budget proposal to Congress, kicking off the annual budget process. Then there’s the partisan brinksmanship over the debt ceiling, which was reached in January and if not raised over the next few months could lead to deep cuts in federal spending—or even a catastrophic default on the national debt.

Those of our readers who are not veteran budget wonks may find some of the issues, concepts, and terminology in the budget debate confusing. With that in mind, this issue of Vantage Point offers a concise budget primer.

The National Debt

Let’s start with the national debt, which seems like a simple enough concept, but isn’t.

The national debt in fact consists of two very different components. The first and more important is the debt held by the public, or publicly held debt. When the federal government runs a deficit, it raises money in financial markets to cover the revenue shortfall by selling Treasury notes, bills, and bonds. The publicly held debt is the cumulative total of all such outstanding securities. As of the end of fiscal year 2022, it stood at $24.3 trillion, or 97 percent of GDP. Of this, roughly 70 percent was held domestically, including by the Federal Reserve, state and local governments, institutional investors like pension funds and insurance companies, and private citizens, while the remaining 30 percent was held by foreigners, including foreign governments.

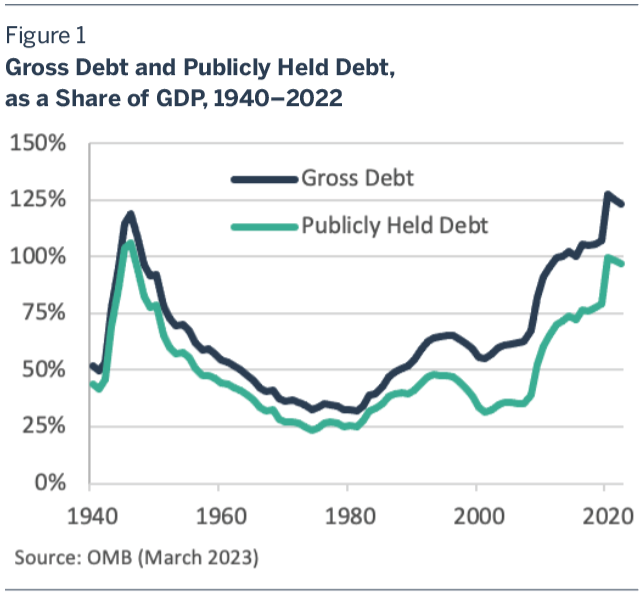

The second component of the national debt is intragovernmental debt, the vast majority of which is held by federal government trust funds. While the federal government owes publicly held debt to external parties, it owes intragovernmental debt to itself. When trust funds like Social Security’s or Medicare’s run surpluses, Treasury “borrows” the money and issues them IOUs in the form of special nonmarketable securities. This intragovernmental debt represents an asset to the trust funds, but a liability to Treasury. Add intragovernmental debt to the publicly held debt and you get the gross debt, or total national debt. As of the end of fiscal year 2022, it stood at $30.8 trillion, or 123 percent of GDP. (See figure 1.)

Economists almost always focus on the publicly held debt, and with good reason. Issuing it is what allows the federal government to pay its bills. It can serve as fiscal stimulus, affect interest rates, and siphon savings away from private investment. Most importantly, the publicly held debt is backed by the full faith and credit of the U.S. government. Defaulting on it could trigger a global financial crisis and do untold damage to America’s economy and stature in the world. Intragovernmental debt is just an internal IOU that Congress, at least in principle, could cancel at any time.

Yet it would be a mistake to conclude that intragovernmental debt is economically and fiscally unimportant. While it may be theoretically possible for Congress to cancel intragovernmental debt, it is highly unlikely that it would ever do so. And so long as that debt exists, Treasury is bound to honor it. The money to do so has to come from somewhere, and since the original trust-fund surpluses have long since been spent by Congress to fund other government activities, there are just three ways to get it: cut other spending, raise taxes, or—you guessed it—borrow from the public. In effect, as the Social Security and Medicare trust funds are drawn down, intragovernmental debt is exchanged for new publicly held debt.

The Debt Ceiling

There is a statutory, though not a constitutional, limit or ceiling on how much debt the federal government can assume. The ceiling applies to what is technically called the “debt subject to limit.” Although there are some small differences, the debt subject to limit is virtually the same as the gross debt, and like it includes both the publicly held debt and intragovernmental debt.

When Congress first enacted a comprehensive debt ceiling in 1939, it was set at $45 billion. Since then it has been raised dozens of times, and now stands at $31.4 trillion. For most of the debt ceiling’s history, raising it rarely caused much controversy. Hikes were made more or less routinely as needed, regardless of which party controlled the White House or Congress. In recent decades, however, partisan brinksmanship has more than once pushed the federal government close to the brink of default.

That of course is where we once again find ourselves. The current debt ceiling was reached on January 19, and the administration and Congress are at loggerheads over whether an increase in it should be “clean” or contingent on spending cuts. While this drama plays out, Treasury has been compelled to resort to so-called extraordinary measures to continue paying the government’s bills as they come due.

These measures involve juggling publicly held debt and intragovernmental debt. To free up room to borrow more from the public without breaching the debt ceiling, Treasury is authorized to temporarily divest itself of certain types of intragovernmental debt, such as securities held by the Thrift Savings Plan’s G Fund and the Civil Service Retirement and Disability Fund. Current estimates are that the extra room for public borrowing that these accounting maneuvers allow will be exhausted sometime this summer.

What happens if the room runs out without Congress either suspending or raising the debt ceiling? There are no statutory guidelines or historical precedents, but most experts assume that Treasury would prioritize paying interest to bondholders, while other spending commitments would be delayed until sufficient tax revenue is on hand to meet them. The delays could be lengthy, painful, and economically damaging, since federal tax revenue is now only sufficient to cover roughly three-quarters of federal expenditures. Everyone from government employees to defense contractors, food stamp recipients, and Social Security beneficiaries could potentially be affected.

Spending, Taxes, and Deficits

Federal spending falls into three broad categories: discretionary spending, mandatory spending, and net interest payments.

Discretionary spending is spending that is subject to the annual appropriations process, meaning that Congress must vote on the spending each year. The discretionary designation notwithstanding, it is what pays for the core functions of government that most people would deem essential, from national defense and homeland security to the IRS, the National Institutes of Health, and the Environmental Protection Agency. For budgeting purposes, the overall discretionary spending category is usually subdivided into defense and nondefense discretionary spending.

Mandatory spending, on the other hand, is set on a kind of autopilot. While discretionary programs must be voted on each year, mandatory programs typically enjoy a permanent appropriation so long as the statutes which authorize them remain in force. All of the major entitlement programs fall into the mandatory spending category, including Social Security, Medicare, Medicaid, the Earned Income Tax Credit, and the Supplemental Nutrition Assistance Program. Indeed, they are entitlements precisely because they are mandatory. Some entitlements are means-tested, meaning that eligibility is subject to an income and/or asset test, while others are non-means-tested.

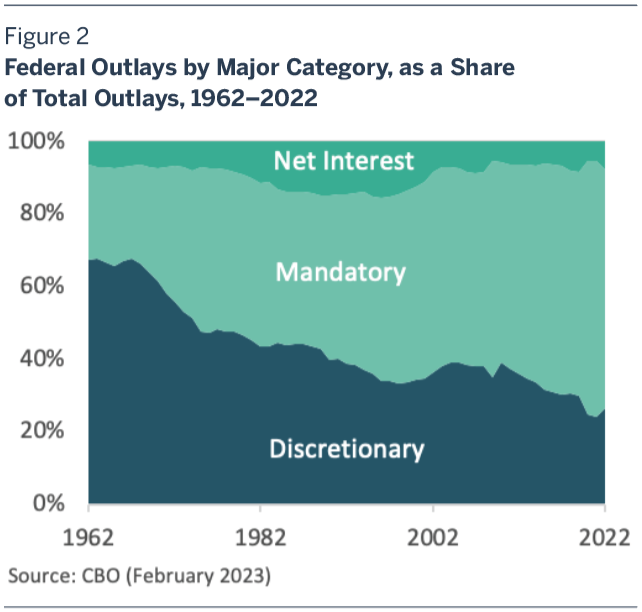

The relative weight of discretionary and mandatory spending in the federal budget has shifted dramatically over the postwar era. As recently as the 1970s, most government spending was discretionary and needed to be appropriated each year. Today, due to program expansions, the aging of the population, and rising health-care costs, mandatory spending dominates the budget. (See figure 2.)

Although net interest payments are also mandatory, they constitute their own category of federal spending. There is, after all, an important difference between payments to federal beneficiaries and payments to bondholders. The federal government can reduce the former by changing the program rules. It cannot reduce the latter short of defaulting on the national debt.

The great majority of federal tax revenue (93 percent in 2022) consists of individual income taxes, payroll taxes, and corporate income taxes, in that order of importance. For current purposes, what’s most noteworthy about federal tax revenue is that in recent decades it has fallen chronically short of covering federal spending. The difference between the two is of course the federal deficit, which must be financed by borrowing from the public.

The federal deficit can be measured in a variety of ways. Since some federal entities and programs, most notably Social Security, are technically “off budget,” the CBO calculates both on-budget and off-budget deficits. While the distinction is relevant for some budgetary procedures, it is economically meaningless. All that matters economically is the difference between total federal spending and total federal taxation, which is what determines the government’s “unified deficit,” or borrowing balance with the public. For analytical purposes, economists at the CBO and elsewhere also calculate two other deficit measures: the “primary deficit,” which excludes net interest payments, and the “structural deficit,” which adjusts the deficit to remove cyclical effects— that is, changes in taxes and spending related to the ups and downs of the business cycle.

Trust Funds

There are dozens of federal trust funds, most of them small. Among the largest and most important are Social Security’s Old-Age and Survivors Insurance (OASI) Trust Fund and Medicare’s Hospital Insurance (HI) Trust Fund.

Unlike private trust funds, which are invested in marketable financial assets, federal trust funds are simply accounting devices that the government uses to keep track of earmarked tax revenue and associated program expenditures. As noted above, when earmarked tax revenue exceeds those expenditures, Treasury issues the trust funds IOUs in the form of special nonmarketable securities. When expenditures exceed earmarked tax revenue, the programs can redeem those securities, allowing full benefits to be paid. Social Security and Medicare are now doing just that.

According to the latest CBO projections released in February, Social Security’s OASI trust fund will be exhausted in 2032 and Medicare’s HI trust fund will be exhausted in 2033. What happens then? Since program expenditures by law cannot exceed earmarked tax revenue once the trust funds are exhausted, benefits would have to be reduced if Congress takes no remedial action before then. Most experts assume that the reduction would be across-the-board, since there are no rules in place for prioritizing some types of beneficiaries over others. In the case of Social Security, an across-the-board reduction would, according to CBO’s calculations, translate into an immediate 23 percent cut in every benefit check. Each year, moreover, the size of the cut would grow.

The Budget Process

The federal budget process, which is governed by the Congressional Budget Act of 1974, is complex and, in practice, often circumvented. Here we simply touch on a few essential points while ignoring most of the details.

The process is kicked off when the President submits his proposed budget to Congress, which is supposed to occur the first Monday in February but may be delayed, as it was this year. The President’s budget serves as a statement of the administration’s policy priorities, and Congress is free to adopt, alter, or entirely ignore it. After all, under the Constitution it is Congress that has the power of the purse.

In principle, Congress is supposed to adopt its own budget plan, called a “budget resolution,” that sets overall revenue and spending targets for the next five or ten years, a time horizon known as the “budget window.” The budget resolution, if Congress adopts one, may include “reconciliation instructions,” which provide an expedited process for making changes to tax provisions and mandatory spending programs that circumvents the Senate filibuster, thereby allowing legislation to pass with a simple majority vote.

With or without a budget resolution, what Congress must do is to pass annual appropriations bills that establish discretionary spending levels for the coming fiscal year. There are twelve regular appropriations bills, though they may be and often are packaged together into a single “omnibus” bill. If Congress does not pass all of the appropriations bills, or if the President vetoes one or more of them, Congress may enact a “continuing resolution,” which allows spending to continue for some specified period of time, but generally less than the entire fiscal year.

Failing that, there may be a government shutdown. Shutdowns do not occur because Treasury lacks the revenue to pay the government’s bills, but because Congress has failed to approve the spending. Partial government shutdowns have occurred many times, most recently in 2018–19.

The Budget Outlook

The CBO publishes ten-year budget projections each year that serve as the official baseline in budget deliberations. It also publishes longer-term budget projections over a thirty-year time horizon.

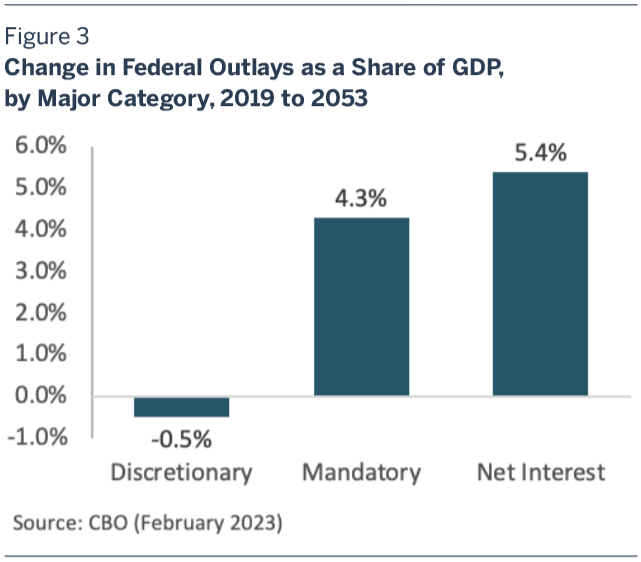

The outlook is not reassuring, either near term or long term. Discretionary spending will continue to shrink as a share of GDP, despite pressing domestic investment needs and growing global threats, while mandatory spending and net interest costs will both grow rapidly. (See figure 3.) By 2028, net interest alone will exceed defense spending, and by 2048 it will exceed total discretionary spending. The deficit will average 6.1 percent of GDP over the next ten years, more than over any ten-year period in the postwar era, and then keep growing. Meanwhile, the publicly held debt will climb to 118 percent of GDP in 2033, more than its historical high of 106 percent at the end of World War II. By 2053, CBO’s projection horizon, it will reach 195 percent of GDP.

These projections should be of concern to all Americans, whatever their political leanings. On our current course, those who favor limited government will be sorely disappointed. But so will those who favor progressive government, if the rest of the budget must be cannibalized to pay for rising entitlement and interest costs.

Then there is the colossal disservice we are doing to the tens of millions of Americans who depend on Social Security and Medicare. You would think that the prospect of deep cuts in these vital social programs would have Congress and the administration scrambling to enact reforms that ensure their sustainability and, to the extent that benefit reductions are needed, give people time to adjust and prepare. But alas, that is not what’s happening. Both political parties are doubling down on their promise not to touch these middle-class entitlements.

As for the national debt, there are some who insist there is no real cause for concern. The United States, as the world’s ultimate investment safe haven and issuer of the global reserve currency, will always be able to borrow as much as it needs in financial markets.

Perhaps, but what if the global financial system of 2030 or 2050 is structured differently than today’s? Ten years, much less thirty, is a long time, especially in an era when the global economic and geopolitical landscape is shifting so rapidly. Do we really want to bet our children’s future on the assumption that the United States will indefinitely enjoy the same privileged borrowing status it does today?