Can an Aging China Still Be a Rising China?

Vantage Point: Mini Briefs from The Terry Group and the Global Aging Institute

July 26, 2023

According to the latest UN projections, China is on track to lose nearly one-half of its current population by the end of the century. Over the past few decades, China’s unusually favorable demographics have helped to propel its stunning economic rise. In the future, its deteriorating demographics threaten to place an ever larger drag on economic growth. In this issue of Vantage Point, we discuss this reversal and the economic and geopolitical risks it poses.

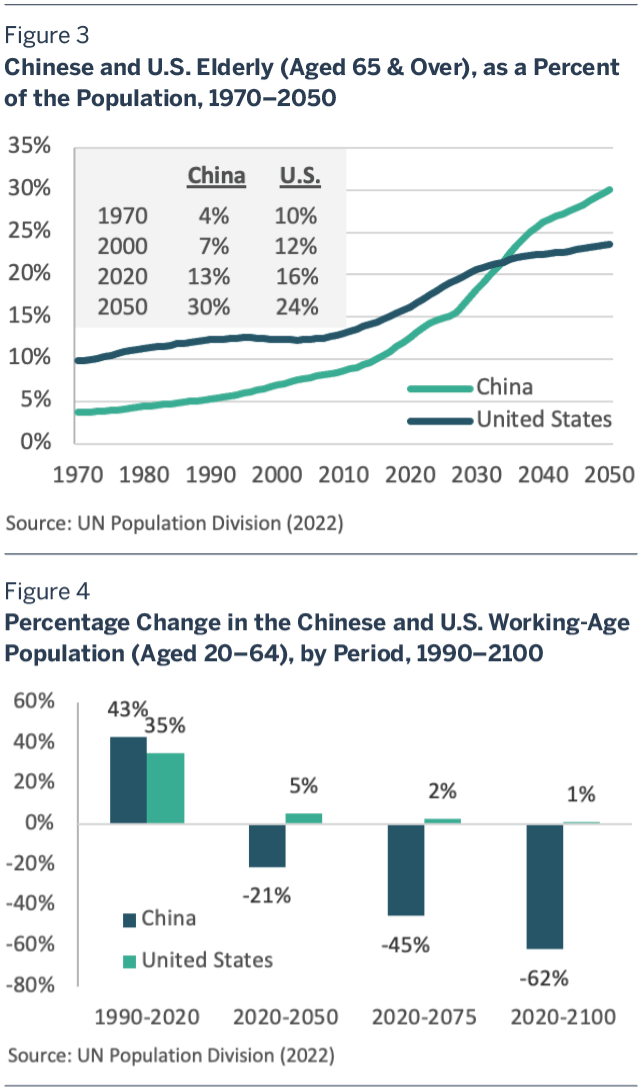

Earlier this year, China’s National Bureau of Statistics reported that the country’s population shrank in 2022 for the first time since 1961, when China was in the grips of a devastating famine caused by Mao’s Great Leap Forward. While that earlier decline was quickly reversed, this one will continue to deepen for the foreseeable future. According to the latest UN projections, China is on track to lose nearly one-half of its current population by the end of the century. Along with a shrinking population, China will also have an aging population. As recently as 1990, just 5 percent of Chinese were aged 65 and over. By 2050, that share will reach 30 percent.

Over the past few decades, China’s unusually favorable demographics have helped to propel its stunning economic rise. In the future, its deteriorating demographics threaten to place an ever larger drag on economic growth. In this issue of Vantage Point, we discuss this reversal and the economic and geopolitical risks it poses.

An Unusually Large Demographic Dividend

To understand the outsized role that population trends have played and will continue to play in shaping China’s economic fortunes, it is necessary to understand the demographic transition—the shift from high mortality and high fertility to low mortality and low fertility that accompanies development and modernization.

This transition unfolds in three stages. During the first stage, mortality rates decline, especially for infants and children, while fertility rates remain high. Rising youth dependency burdens and explosive population growth tend to lean against economic growth. The second stage of the transition begins when fertility rates also fall, typically with a lag of a generation. During this stage, youth dependency burdens decline and population growth moderates, opening up a window of opportunity for development known as the “demographic dividend.” Eventually, the growth in the number of elderly overtakes the decline in the number of children, ushering in the third and final stage of the transition. Old-age dependency burdens rise and, depending on how far fertility rates have fallen, populations stagnate or contract. Once again, demographic trends tend to lean against economic growth.

Most countries enjoy a period of favorable demographics midway though the demographic transition. But China’s demographic dividend was unusually large because its fertility decline was unusually steep. By the 1970s, with infant and child mortality rapidly falling, the government became alarmed that unchecked population growth might leave China mired indefinitely in poverty. In response, it began to put in place increasingly draconian restrictions on family size, culminating in the introduction of the one-child policy in 1980. In 1970, the Chinese total fertility rate (TFR), a measure of average lifetime births per woman, was a towering 6.1. By 1991, just twenty-one years later, it had fallen beneath 2.1, the so-called replacement rate needed to maintain a stable population from one generation to the next.1 As of 2022, China’s TFR was just 1.2, making it one of the lowest fertility countries in the world.

As China’s fertility rate fell, its youth dependency burden plunged and the share of the population in the working years soared, rising from 46 percent in 1975 to a peak of 66 percent in the early 2010s. With more producers relative to the number of dependents, the growth rate in per capita living standards accelerated. Beyond the direct impact of China’s changing age structure, its declining dependency burden also led to changes in economic behavior that further accelerated the pace of living standard growth, including increased labor-force participation, especially by women, higher savings rates, and greater investment in human capital.2

To be sure, China’s favorable demographics alone did not guarantee its economic success. Many emerging markets, from Latin America to the Greater Middle East, have enjoyed significant demographic dividends with little to show for them economically. Policies matter, and China pursued the right ones. Like Japan, South Korea, and the other “East Asian Tigers” before it, China implemented an export-led growth strategy, starting with basic manufacturing. This allowed it to shift its masses of unskilled rural laborers into factory jobs, where they could be instantly plugged into the global economy. At the same time, China made large-scale investments in human capital, and especially quality secondary education, which ensured that the next generation of workers would have the necessary skills as China moved up the global value-added scale.

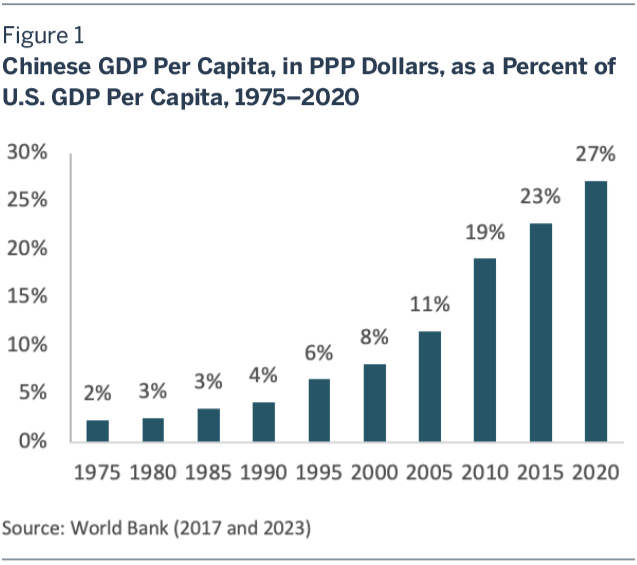

By any measure, China’s economic rise has been stunning. Its GDP has grown sixteenfold in real terms since 1990, when it first began to emerge as the factory floor of the world. Back then, China’s GDP was just one-tenth the size of America’s; today it is four-fifths the size. The gap in living standards between China and America has also narrowed dramatically. In 1990, Chinese GDP per capita, even measured in Purchasing Power Parity (PPP) dollars that take into account differences in the cost of living, was just 4 percent of U.S. GDP per capita. As of 2020, it was 27 percent, and that’s a national average that includes China’s less-developed rural regions. (See figure 1.)

The Coming Demographic Gauntlet

At the time the one-child policy was put in place, no one in the Chinese government gave much thought to its ultimate consequences. The challenges posed by population aging and population decline lay far over the horizon in a distant future.

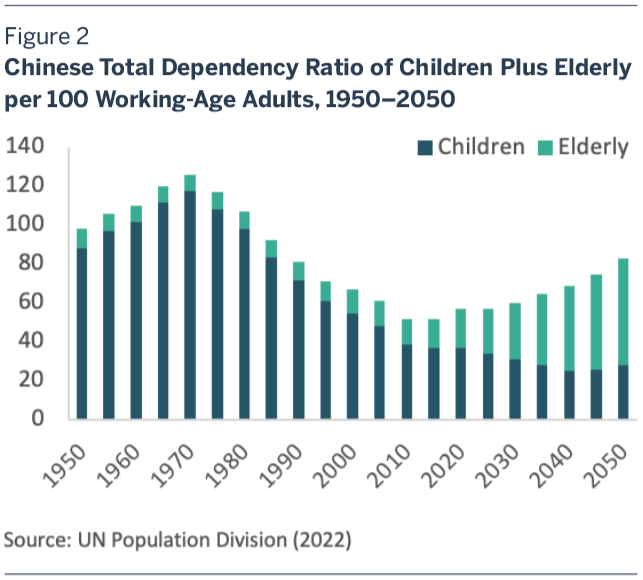

Today that future has arrived. The number of elderly is now increasing much faster than the number of children is declining, pushing China’s overall dependency burden back up. (See figure 2.) In 1975, there were thirteen times as many children as elderly in China. By 2050, the UN projects that there will be twice as many elderly as children. As recently as 1990, just 5 percent of China’s population was aged 65 and over. Today, 14 percent is. In 2050, 30 percent will be. By then, China will be a considerably older country than the United States. (See figure 3.)

China’s population is not only aging, but is also entering a gathering decline that will be difficult, if not impossible, to reverse. Gone are the days when China’s deep reservoir of labor seemed inexhaustible. By 2050, the UN projects that its working-age population will shrink by one-fifth. By 2100, unless birthrates or immigration increase substantially, it could shrink by three-fifths. (See figure 4.) Already by the 2030s, China will be losing an average of seven million working-age adults each year; by the 2050s, it will be losing an average of twelve million.

These demographic trends have profound implications for the size and shape of China’s government. The burgeoning elderly population, whose numbers will be approaching 400 million by 2050, will put an enormous burden on families, which still play a central role in retirement security in China. Inevitably, much of that burden will be shifted to government as urbanization, industrialization, and declining family size force a vast expansion of China’s underdeveloped welfare state.

Even as fiscal burdens rise, economic growth will slow. Between 1990 and 2010, when China’s demographics were still highly favorable, its working-age population grew at an average annual rate of 1.7 percent. Between 2030 and 2050, when they will have turned decisively negative, it will be contracting at an average annual rate of 1.0 percent. All other things being equal, this nearly 3 percentage point reduction in the growth rate in the working-age population will translate into an equivalent reduction in the growth rate in employment and potential GDP.

If China’s economy were otherwise healthy, it might be better prepared to run the coming demographic gauntlet. But in recent years it has fallen prey to a host of ailments. There is the rigid household registration or “hukou” system that threatens to turn rural migrants into a permanent urban underclass. There is the massive misallocation of capital by state-owned banks, the ballooning local government debt crisis, and high youth unemployment. Then there is the central government’s increasingly heavy-handed interference in the private sector, which threatens to throttle innovation just when China needs it most. All of this helps to explain why, according to the IMF, productivity growth, the other driver of GDP growth, has slowed dramatically since the early 2010s.3

Three Traps

It took China’s leadership a while to wake up to the emerging new realities, but by now it understands that population aging and population decline pose a grave threat to the country’s future prosperity. In 2015, the one-child policy was changed to a two-child policy, and in 2021 to a three-child policy. Serious consideration is even being given to abolishing limits on family size altogether. Meanwhile, family planning offices that once upheld the one-child policy with forced sterilizations and abortions are now being repurposed to encourage more births.

Thus far, none of this has made any difference. Far from rising since the one-child policy was relaxed, China’s TFR has fallen. There are many reasons for this, including the high cost of housing and education and the challenges that women face in balancing job and family responsibilities. Yet it also seems that China may have fallen into what demographers call a “low fertility trap.” Quite simply, after two generations of below-replacement fertility, the one-child family has become the new social norm.

To be sure, low fertility is not just a Chinese problem. The trend toward smaller family size began in the rich world, and by now it has overtaken most of the emerging world as well. Many other East Asian countries have fertility rates that are as low as or even lower than China’s. As of 2022, Japan’s TFR was 1.3, Taiwan’s was 1.1, and South Korea’s was just 0.8.

This suggests that China’s fertility rate would have fallen on its own, even without the one-child policy. While this is no doubt true, it would not have fallen so steeply, so soon. What the one-child policy did was to pull down China’s fertility rate at an earlier stage of development than would otherwise have been the case, thus helping to speed economic growth. But what demography gives, demography can take away. The one-child policy also ensured that China would age at an earlier stage of development than would otherwise have been the case. Today’s developed countries grew rich before they grew old. China is growing old first, which means that it may never grow rich.

Many emerging markets have risen from low-income to middle-income status, only to languish there for decades without ever attaining high-income status. The premature aging of China’s population will make avoiding this “middle income trap” even more challenging. As China’s workforce ages, it is likely to become less mobile, less flexible, and less entrepreneurial. As the number of elderly grow, more of national income will be devoted to honoring pension claims and paying medical bills, and less to investment in the future.

Along with the low fertility and middle income traps, there may be a third and even more perilous trap. Until recently, most projections showed that China would overtake the United States in economic size by the end of the 2020s and eventually dwarf it later in the century. Given China’s demographic and economic troubles, this scenario now seems increasingly unlikely.

Some current projections, including those by Capital Economics and the Japan Center for Economic Research, suggest that China may never overtake the United States in economic size. Others still project that it will, but later and by a much narrower margin than once seemed likely. Current projections by Goldman Sachs, for instance, show that China will overtake the United States in 2035, nine years later than it was projecting as recently as 2011. In 2075, the Goldman Sachs projection horizon, Chinese GDP would exceed U.S. GDP by a mere 11 percent. As for per capita GDP, China would never come close to catching up with the United States.4

Historically, competition between rising powers like China and incumbent powers like the United States has often led to war. Some might hope that China’s changing fortunes will diffuse what is sometimes called the “Thucydides trap,” a reference to the Athenian historian who argued that the threat a rising Athens posed to Sparta, his day’s incumbent power, made war between the two inevitable. In fact, far from reducing the risk of great power conflict, the dimming of China’s long-term growth prospects may increase it. So long as the future seemed to be on China’s side, it could bide its time and “peacefully rise.” If China determines that the tide is turning against it, it may conclude that it must challenge the United States soon or lose the ability to challenge it at all.

Nothing Is Inevitable

None of this is to say that China’s rags-to-riches story is bound to end poorly. With the right economic and social policies in place, China may avoid falling into the middle income trap. In time, it may even escape its low fertility trap. China’s deteriorating demographics pose formidable obstacles to its continued economic rise. They do not, however, preclude it.

Nor is great power conflict inevitable. Avoiding it, however, will require engagement, cooperation, and great restraint on the part of leaders in both Beijing and Washington. This was already true when demographics were propelling China’s economic rise. It is even more true now that they are leaning the other way.