A-Grade Corporate Bond Yield Curve for Valuing Long-Duration Insurance Contracts

Bond Market Update – June 2021

July 6, 2021

The valuation of long-term insurance policy benefits will shift to a current-market valuation basis for large public companies in 2023, with restated liability figures generally required as of the two prior year-ends.

Current market discount rates will be based on an “upper-medium grade” fixed income yield, which is broadly interpreted to mean A-grade corporate bonds.

In valuing future policy benefits, the new FASB rules further specify that insurers reflect the duration characteristics of the liabilities and use valuation rates that maximize reference to observable bond data.

Constructing an Appropriate A-Grade Bond Portfolio

Adhering to these new standards entails an assessment of relevant bond yields across the full range of maturities. The most direct way to reflect market rates is to develop a complete yield curve from a portfolio of A-grade bonds, applying year-by-year rates developed from that curve to discount future policy benefits.

Constructing a curve from market data requires addressing a number of technical and methodology considerations, including:

- range of credit ratings by different rating agencies

- minimum issue size to ensure credible bond trading/pricing

- inclusion/exclusion/adjustments for bonds with call features and other embedded options

- inclusion/exclusion of private placement, quasi-government and less broadly-traded bonds

- relative quality/appropriateness of pricing sources and timing for end-of-day price measures

- potential curve-fitting approaches, with varying emphasis on tightness of data-fit vs. smoothness

- extrapolation of long-end rates, beyond the range of credible bond data (a critical factor since payments for many insurance products extend well past 30 years).

Ensuring acceptance by auditors will require that the yield curve be comprehensively documented, consistently applied, and provide results closely reflective of current capital markets and market changes across time.

Bond Market Update

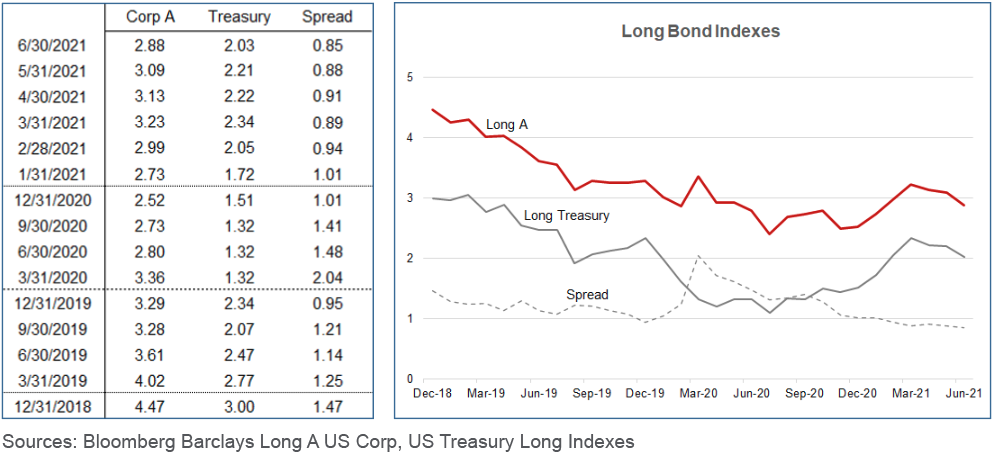

Monitoring generally available market information such as bond index averages is necessary to ensure market consistency. Any variation in model vs. market results should be evaluated and rationalized.

Long bond yields fell in June, the third monthly decrease following a series of significant yield increases in the first quarter. Long yields remain up about 40 basis points for the year. Recent yields represent historic low levels, and most analysts expect rates to remain low for the near term given the maturation of the economy and the continuation of expansionary government monetary policy. Of course, long bond yields will also be impacted by inflation expectations and the demand for capital funds, both of which could head upward with a strong economy recovery in the context of recent monetary supply growth.

Building and Applying a Yield Curve

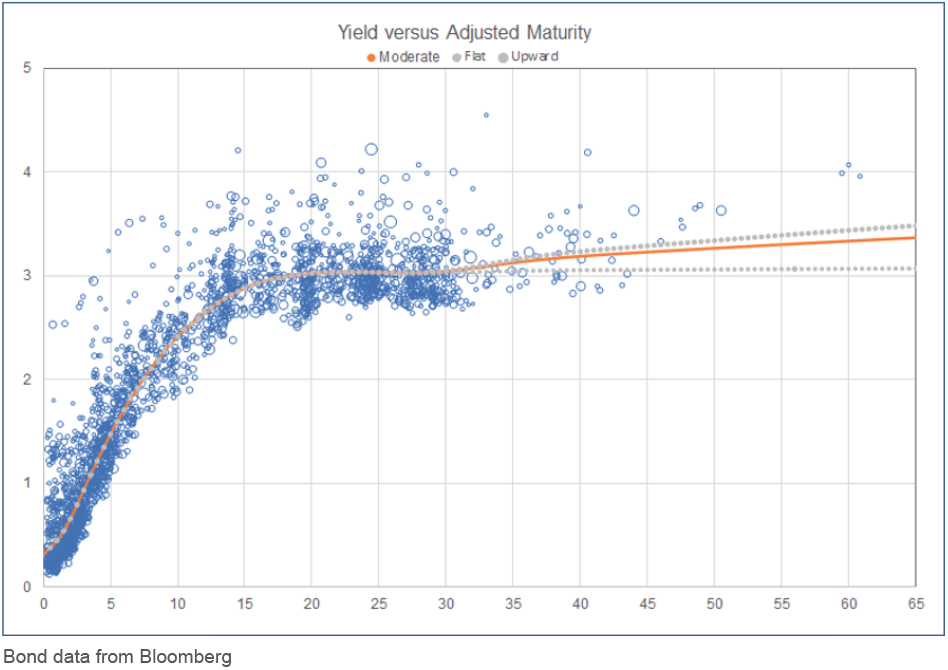

The following exhibits illustrate the results of an A-grade yield curve model developed as of June 30, 2021.

After filtering the A-grade bond universe for grading, optionality and other factors, the portfolio consists of roughly 2,500 bonds. These are arrayed across maturity groups; a curve is then fit to that array, with a goal of reflecting the mean/median yield for each maturity group. Note that two technical adjustments are made in the course of fitting the curve:

- The fitted curve is modified to the extent necessary to ensure a relatively smooth pattern of yields, with these adjustments very closely controlled to ensure that the overall curve maintains an accurate representation of mean/median yield levels.

- The bonds are characterized, and maturity group averages determined, based on “adjusted” rather than nominal maturities. These adjustments are necessary since the fitted curve is based on a par bond assumption, while few bonds pay coupons at current market rates.* Thus, the bonds are reflected in curve-building at maturity points that align each bond’s actual duration with that of a par bond.

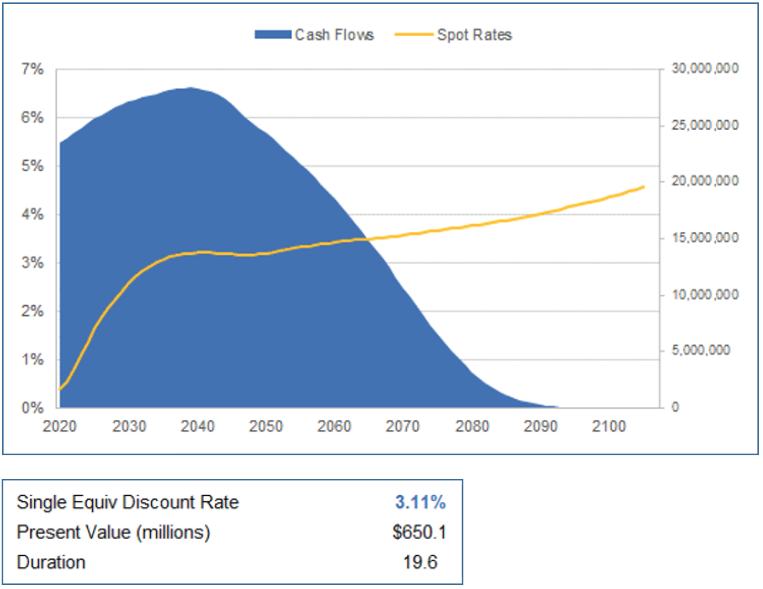

Once yields have been determined at each maturity point, spot rates can be derived (based on a methodology termed “bootstrapping”). These spot rates are then applied to a given set of projected benefit cash flows, and a present value determined. Often, a flat/single equivalent discount rate consistent with that present value is calculated and used to represent the valuation result.

The example below reflects a very long duration cash flow (e.g., that for a deferred income annuity), along with the application of The Terry Group’s moderate or baseline yield curve:

Variations in Discount Rate Outcomes

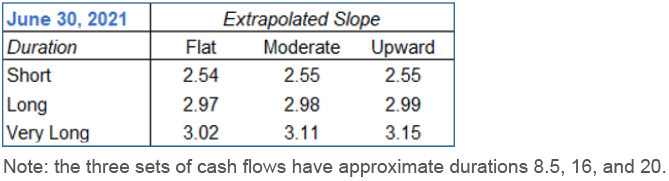

Discount rate outcomes almost always vary based on the duration of a given set of benefit cash flows—since the yield curve is almost never totally flat. Another element of variation in outcomes results from the approach taken to extrapolate the curve beyond the maturity point at which the most credible data ends—generally considered to be at about 30 years. The extrapolation impact will of course vary based on the duration of a given cash flow, i.e., for durations of 15 or less there may be little impact.

The Terry Group’s June portfolio includes 80 bonds with maturities beyond 30 years, 20 of which have maturities beyond 40 years. This information, though limited, enables a range of possible extrapolation approaches:

Discount rate results have moved up about 35 basis points for the year, generally in line with the increase in index average yields. However, the summarized discount rate outcomes indicate that the dispersion in results based on duration is considerable—there is a range of 50–60 basis points across our three sample cash flows. This variation in results is especially noteworthy in the current context of a not particularly steep yield curve.

The variation in results based on the choice of extrapolation approach is less significant, ranging from 1 to 13 basis points depending on duration. (Obviously, a cash flow stream with a significant long tail will be more affected by the approach used to extrapolate long bond yields.)

You should expect both sources of volatility—related to duration and curve-fitting impacts—to change significantly over time with evolving capital market conditions.

For more information, please contact Jerry Mingione.